PJS Insurance Services

Peter Schumacher AINS, AIS

Serving Arizona & Ohio

Independent for You

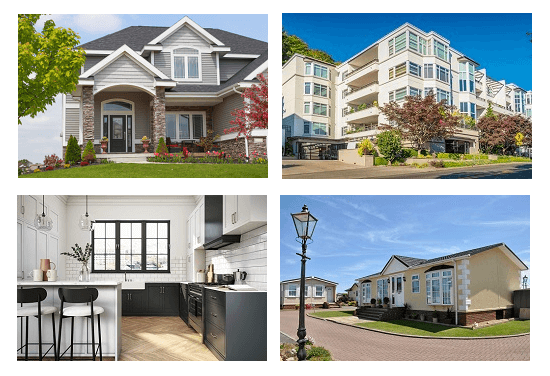

Homeowners Insurance is for more than just your home

Condo | Renters | Mobile/Manufactured Homes | Personal Umbrella

Home Insurance Basics: A Beginner's Guide

By Peter Schumacher, AINS, AIS — Edited and Refined with AI Assistance

Welcome to the first page of our Home Insurance Basics series! At PJS Insurance Services, led by Peter Schumacher AINS, AIS, we understand that navigating the world of home insurance can feel overwhelming. Whether you are just starting out or just received your renewal notice, this page will break down the fundamentals of homeowners insurance, ensuring you understand the basics to protect your home and your budget. Future pages will delve into customizing your policy based on your specific needs and how to secure the best coverage and savings for your home, condo, mobile home, or as a renter. Let’s start with the foundation: what is home insurance, and why do you need it?

If you have additional questions feel free to call or Request more Information.

What is Home Insurance and Why is it Important?

Home insurance, often referred to as homeowners insurance, is a contract between you and an insurance company that helps protect your finances if your home or possessions are damaged or destroyed by covered events. In short, it is designed to provide financial protection for your biggest investment. It can also provide liability coverage if someone is injured on your property. It's a safety net against unexpected disasters, offering peace of mind knowing you're protected. A local home insurance provider like PJS Insurance Services can help you navigate this process.

What Does Homeowners Insurance Cover?

Dwelling Coverage:

This covers the structure of your home, including the walls, roof, and attached structures like a garage or deck. It protects against damage from covered perils, such as fire, windstorms, hail, lightning, and vandalism. Did you know that in 2022, lightning was the cause of 51,925 home insurance claims, for $657 million (Source: https://www.iii.org/fact-statistic/facts-statistics-lightning ).

Personal Property Coverage:

This protects your belongings inside your home, such as furniture, electronics, clothing, and appliances. It usually covers these items even if they are temporarily away from your home.

Liability Coverage:

This protects you if someone is injured on your property and you are found legally responsible. It can cover medical expenses, legal fees, and settlements. Dog bites account for more than one-third of all homeowners insurance liability claim dollars paid out in 2022, costing $1.13 billion (Source: https://www.iii.org/article/spotlight-on-dog-bite-liability).

Additional Living Expenses (ALE):

If a covered event makes your home uninhabitable, ALE coverage can help pay for temporary housing, meals, and other living expenses while your home is being repaired.

What Doesn't Home Insurance Cover?

While home insurance offers broad protection, it's important to understand what it doesn't cover. Common exclusions include:

Flood Damage:

Standard homeowners policies typically do not cover flood damage. You'll need a separate flood insurance policy for this.

Earthquake Damage:

Similar to flood coverage, earthquake damage usually requires a separate policy.

Wear and Tear:

Home insurance is not designed to cover routine maintenance or gradual wear and tear.

Protect your home with tailored Home Insurance coverage. Compare rates from top providers in Arizona & Ohio. Save More Today!

How Much Home Insurance Do You Need?

Determining the right amount of coverage is a critical step in securing your home. In order to buy home insurance that fits your needs, keep these points in mind:

Dwelling Coverage:

Aim for enough coverage to rebuild your home if it were completely destroyed. Get an estimate from a local contractor to determine the current cost of construction in your area.

Personal Property Coverage:

Take an inventory of your belongings and estimate their value. Consider whether you want "replacement cost" coverage (which pays the cost to replace the item with a new one) or "actual cash value" coverage (which factors in depreciation).

Liability Coverage:

Choose a liability limit that is sufficient to protect your assets if you are sued. A minimum of $300,000 is generally recommended, but higher limits may be appropriate depending on your financial situation.

Factors Affecting Home Insurance Rates

Several factors influence your home insurance premiums:

Location:

Your location plays a significant role. Homes in areas prone to natural disasters (like wildfires in Arizona or severe storms in Ohio) may have higher rates. Arizona is rated as the 13th highest state for Home Owner Claims (source: https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance). Ohio is rated as the 23rd highest state for Home Owner Claims (source: https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance).

Home Age and Condition:

Older homes may have higher rates due to outdated wiring, plumbing, or roofing.

Coverage Amounts:

Higher coverage limits will result in higher premiums.

Deductible:

A higher deductible (the amount you pay out-of-pocket before insurance kicks in) will typically lower your premium.

Claims History:

If you've filed multiple claims in the past, your rates may be higher.

Credit Score:

In many states, your credit score can impact your insurance rates.

Protective Devices:

Security systems, smoke detectors, and other safety features can often lead to discounts.

Home Insurance in Arizona and Ohio: What You Need to Know

While the basics of home insurance are consistent across states, there are some nuances to keep in mind for Arizona and Ohio residents:

Arizona:

Be aware of the risk of wildfires and ensure your policy covers wildfire damage. Also, consider the potential for monsoon storms, flash floods and hail. The Arizona Department of Insurance and Financial Institutions (DIFI) offers valuable resources for homeowners: https://difi.az.gov/home-insurance.

Ohio:

Be prepared for severe weather, including winter storms, tornadoes, and hail. Understand your policy's coverage for wind and hail damage. The Ohio Department of Insurance provides a comprehensive guide to homeowners insurance:https://insurance.ohio.gov/consumers/homeowner/homeowners-insurance-guide.

How to Choose Home Insurance

Research and Compare:

Compare home insurance rates from multiple companies. As an independent insurance agency, PJS Insurance Services can shop the market on your behalf, accessing multiple providers to find you customized insurance solutions at competitive prices.

Read the Fine Print:

Carefully review the policy documents to understand the coverage details, exclusions, and limitations.

Consider Your Needs:

Think about your specific needs and risks and choose a policy that provides adequate protection.

Get Expert Advice:

Consult with an insurance professional who can assess your situation and recommend the right coverage.

PJS Insurance Services: Your Trusted Partner in Arizona & Ohio

At PJS Insurance Services, we're dedicated to providing personalized service and expert guidance. Peter Schumacher AINS, AIS, leads our team of experienced professionals who are committed to helping you find the best home insurance coverage at a price that fits your budget. As a trusted Independent Insurance Agency, we work for you, not the insurance company.

Ready to Protect Your Home?

Understanding how to choose home insurance does not have to be complicated. Get a free home insurance quote online today or call us for more information! We're here to answer your questions and help you find the right coverage.

Compare Home Insurance Rates & Save More Today!

Get a Free Online Quote:

Call Us Today:

AZ - click to call

OH - click to call

Frequently asked questions (FAQ)

Is homeowners insurance mandatory?

While not legally required in most states (unless required by your mortgage lender), homeowners insurance is highly recommended to protect your financial investment.

Why are my premiums increasing, and what can I do to lower my costs?

Premiums can increase due to factors like inflation, increased claims in your area, and changes to your coverage. To lower costs, consider increasing your deductible, bundling your insurance policies, and reviewing your coverage needs annually.

Am I insured for replacement cost or actual cash value (ACV)?

Replacement cost coverage pays to replace damaged items with new ones, while ACV coverage factors in depreciation. Replacement cost coverage is generally recommended for better protection.

What questions should I ask about homeowners insurance?

Ask about coverage limits, deductibles, exclusions, discounts, and the claims process.

What two events are not covered under homeowners insurance?

Typically, flood and earthquake damage are not covered by standard homeowners policies and require separate coverage.

Disclaimer

This information is for general guidance only and should not be considered legal or financial advice. Consult with a qualified insurance professional for personalized recommendations.

This webpage has been created using AI assistance in content drafting, with thorough editorial review and refinement by Peter Schumacher, AINS, AIS. Peter is committed to an iterative prompt refinement process to ensure the accuracy, clarity, and helpfulness of the material.

Serving Mesa, Gilbert, Queen Creek and the state of Arizona. PJS Insurance Services should be your first and last stop when looking for Arizona Home insurance.

There is a difference. To find out how our Independent insurance agency in Mesa can help you find the right AZ Home insurance coverage, please contact PJS Insurance Services. Give us a call today at (602) 750-0616.

Now serving Toledo, Sylvania, Ottawa Hills and the state of Ohio. PJS Insurance Services offers you more choices to find affordable Ohio Homeowners Insurance.

Experience the difference. To find out how your Ohio Independent insurance agents can help you find the Best Home insurance Toledo OH, please contact PJS Insurance Services. Give us a call today at (419) 318-9130.

Home Insurance in Arizona or Ohio-have more questions?

Call PJS Insurance Services at (602) 750-0616 in Mesa, AZ or (419) 318-9130 in Toledo, OH.

Feel free to go to the main Home Insurance Basics page for more information. There are a lot of different types of coverages for a lot of different types of households. Here to help with the lowest prices from the best companies.

Select your choice below for additional information and coverage options to customize your plan or send me your questions here.

PJS Insurance Services

Locations

Mesa

86 Leisure World

Mesa, AZ 85206

(602) 750-0616

(480) 269-1436

Toledo

5151 Monroe St Ste 250F

Toledo, OH 43623

(419) 318-9130

Sitemap - XML | Privacy | Disclaimer | Sitemap - HTML

© 2024 PJS Insurance Services - All rights reserved